How NBFCs Make Money: Models, Metrics & Risks...Part 2 of NBFC Series

Explore how Indian NBFCs operate: lending models, capital sources, risks, key metrics, and why MSME lending is emerging as their core growth engine.

When it comes to the world of financial services, NBFCs (Non-Banking Financial Companies) are often treated like the interesting but misunderstood sibling of banks. They’re nimble, creative, and capable of taking on roles banks traditionally shy away from. But they also come with their fair share of quirks and risks—quirks that a savvy investor should know about.

If you read Part 1 of this series, you’ll remember we discussed how NBFCs emerged, faced crises, and were molded by reforms over the decades. Now, we’ll roll up our sleeves and dig into the mechanics—how NBFCs make money, their strengths, risks, and what you should look for as an investor.

By the time you finish this guide, you’ll know how to separate the wheat from the chaff and identify solid investment opportunities in this sector.

📘 Missed Part 1? Read the origin story, crises, and regulatory transformation of NBFCs Check Out the the post below ⬇

India’s Financial Underdogs: The Rise of NBFCs & Microfinance

The Indian financial system is like an intricately woven fabric, with every strand playing a pivotal role in its stability and growth. But while banks have traditionally dominated the landscape, an army of financial underdogs has quietly been making waves—NBFCs (Non-Banking Financial Companies) and MFIs (Microfinance Institutions).

🧠 A. Types of NBFCs

India's Non-Banking Financial Companies (NBFCs) are not monolithic entities. They cater to diverse borrower segments, operate under varied regulations, and pursue different business models. The Reserve Bank of India (RBI) classifies NBFCs into several types based on the nature of their activity, asset composition, and sectoral focus. Understanding these types is key to understanding how financial services are delivered to the last mile in India.

1. Investment & Credit Companies (ICCs)

ICCs represent the broadest and most versatile category of NBFCs. They are permitted to engage in both asset financing and lending operations. This flexibility allows them to serve a wide range of borrowers, from consumers purchasing electronics or household appliances on EMI to small businesses seeking working capital. ICCs often rely on a mix of collateral-based and unsecured lending, and their portfolio mix can include personal loans, consumer durable loans, business loans, and even small-ticket retail finance.

Some ICCs specialize in unsecured digital lending, leveraging tech-driven models, while others act more traditionally with on-ground collection networks. The regulatory treatment is evolving, especially as digital lending norms take center stage.

2. Housing Finance Companies (HFCs)

HFCs are specialized NBFCs that cater to housing needs, offering home loans to salaried individuals, self-employed professionals, and informal segment borrowers. Historically regulated by the National Housing Bank (NHB), they now fall under RBI supervision.

HFCs play a critical role in India's housing growth, especially in Tier II, Tier III cities and rural markets. Affordable housing is a key focus, with government schemes like PMAY (Pradhan Mantri Awas Yojana) acting as a demand booster. HFCs must maintain a higher capital adequacy ratio and follow strict provisioning norms to safeguard against default risk.

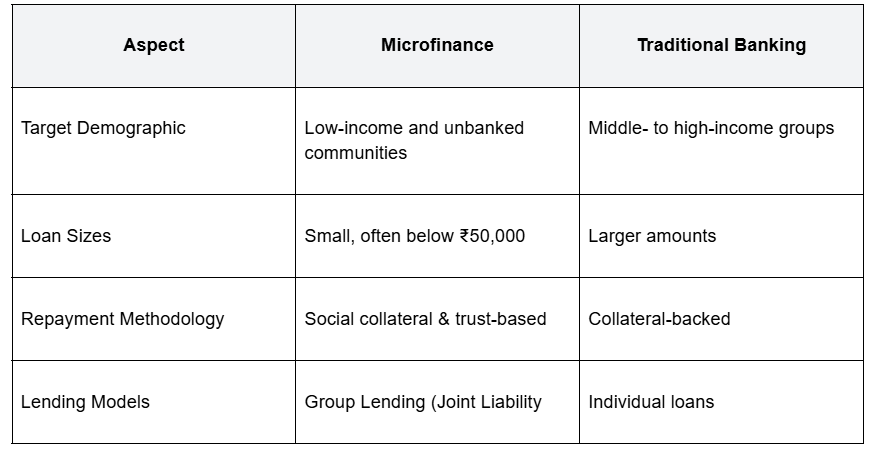

3. Microfinance Institutions (MFIs)

NBFC-MFIs are institutions that cater primarily to the financial needs of low-income households, predominantly women, through small-ticket loans. These loans are typically unsecured and use a group lending format known as Joint Liability Groups (JLGs).

MFIs serve as critical financial lifelines in rural and semi-urban India, where access to formal banking is limited. The regulatory framework for MFIs is more prescriptive. There are caps on interest rates, borrower indebtedness, and loan sizes. MFIs must adhere to a borrower-first philosophy and ensure ethical collection practices.

4. Asset Finance Companies (AFCs)

AFCs focus on financing assets that enable productivity. This includes commercial vehicles, construction equipment, tractors, farm implements, and industrial machinery. Their client base is often self-employed individuals or micro-enterprises whose livelihoods depend on these assets.

AFCs play a key role in enabling economic activity in both rural and urban India. However, they are exposed to asset depreciation risk, especially if asset repossession becomes difficult during economic downturns.

Each of these NBFC types has a unique regulatory framework. MFIs, for instance, have interest rate caps and borrower exposure limits. HFCs must maintain minimum capital adequacy and follow NHB guidelines on provisioning. ICCs and AFCs have relatively more flexibility but are still bound by RBI norms. The scale-based regulation introduced in 2021 now classifies NBFCs into base, middle, and upper layers depending on size and complexity, further affecting how they are governed.

💳 B. Lending Models

NBFCs and MFIs use various underwriting and lending models tailored to the risk profile and economic behavior of their customers. Their differentiation lies not just in the products they offer but in the methodology they use to lend and collect.

1. Collateral-Based Lending

In collateral-based lending, a physical or financial asset secures the loan. AFCs primarily use this model, accepting assets such as vehicles, tractors, or equipment as security. Many HFCs and ICCs also adopt this for housing loans or LAP (Loan Against Property).

Collateral-based models lower credit risk but limit inclusion, as many informal borrowers lack clear property titles or formal asset ownership. The underwriting in such cases is conservative, often requiring robust documentation and valuation.

2. Group-Based Lending

Microfinance Institutions have innovated with the Joint Liability Group (JLG) model. Here, 5–10 women form a group and collectively guarantee each other’s loans. This peer accountability mechanism ensures high repayment rates despite the loans being unsecured.

The model also enables MFIs to scale rapidly without traditional credit scoring. It builds social capital and has been instrumental in empowering rural women economically.

3. Cash Flow & Psychometric-Based Lending

Urban-centric NBFCs catering to MSMEs or gig workers use alternate credit assessment models. With limited or no credit history, borrowers are evaluated based on business cash flows, GST data, bank statements, and transaction data.

Some fintech NBFCs use psychometric assessments to gauge borrowers’ honesty, risk appetite, and discipline. This model is prevalent in lending to new-to-credit segments and digitally savvy urban populations.

In summary, the lending model an NBFC adopts is tightly linked to its borrower profile and operational strategy.

📅 C. Credit Discipline

NBFCs excel at maintaining credit discipline using a combination of field force, borrower engagement, and technology.

1. Physical and Digital Collections

For MFIs and MSME-focused lenders, field collection is integral. Collection officers regularly visit customers and build relationships that promote repayment. The presence of a known field agent increases accountability.

Digitally-enabled NBFCs complement this with automated reminders, payment links, and EMI dashboards.

2. Group Dynamics

Group lending not only boosts credit access but enforces a collective repayment ethic. Defaults are socially discouraged, and group members have a vested interest in each other's financial discipline.

3. Tech Nudges

Tech-savvy NBFCs use WhatsApp nudges, SMS reminders, in-app push notifications, and even IVR calls. AI-driven platforms can now predict which borrowers are likely to delay payments and proactively engage them.

4. Differentiated Delinquency Handling

NBFCs move faster than banks. A missed EMI might prompt a call the next day. Smaller NBFCs often restructure loans more swiftly, offering extensions or top-ups to tide borrowers over temporary stress.

Their nimbleness is particularly evident in MSME segments, where cash flow volatility is high. In contrast, banks often follow bureaucratic processes, which can be slow and impersonal.

💶 D. Sources of Capital

NBFCs rely on diversified sources of funding, especially since most cannot accept public deposits. Their funding strategy directly impacts growth, pricing, and risk.

1. Bank Lines of Credit

Banks extend term loans or working capital lines to NBFCs. These are the most common and stable form of debt. But in times of systemic stress, such as during the IL&FS crisis, banks tend to curtail exposure, squeezing liquidity.

2. NCDs (Non-Convertible Debentures)

NBFCs issue NCDs to mutual funds, pension funds, insurance companies, and even retail investors. These instruments can be secured or unsecured, rated by credit agencies, and are tradable on exchanges.

NCDs allow NBFCs to tap long-term funds and reduce dependency on banks. However, investor sentiment and interest rate cycles influence demand.

3. Securitization

Securitization allows NBFCs to package loans into asset pools and sell them to banks or other institutional investors. This frees up capital and shifts risk off-balance-sheet.

Post-IL&FS, RBI revised norms to increase transparency and reduce misuse. Direct Assignment (DA) is a preferred structure for most MFIs.

4. Refinance Facilities

Institutions like SIDBI (for MSME lending), NABARD (for agri and rural lending), and DFIs like IFC, FMO, or ADB offer refinance lines. MFIs often rely heavily on these, which offer better terms and longer tenures.

NBFCs must actively manage their asset-liability mismatch, ensuring that the average loan tenure aligns with their borrowing profile.

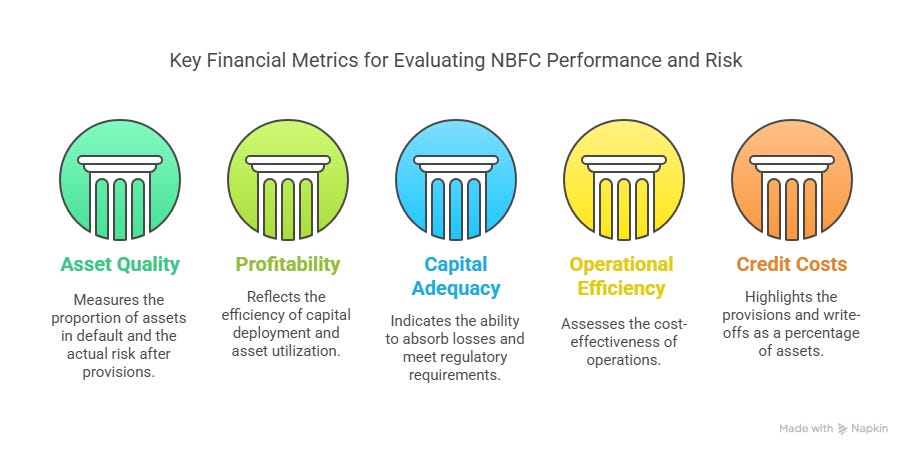

📊 E. Key Metrics Investors Should Watch

For those evaluating NBFCs, especially listed ones, certain financial metrics serve as indicators of operational health, efficiency, and risk profile:

GNPA (Gross Non-Performing Assets): Share of total assets that are in default.

NNPA (Net Non-Performing Assets): GNPA minus provisions, representing actual uncovered risk.

NIM (Net Interest Margin): Yield on assets minus cost of funds. A higher NIM reflects better pricing power and efficient capital deployment.

ROA (Return on Assets): Net income as a percentage of total assets. Indicates profitability and asset utilization.

CAR (Capital Adequacy Ratio): Determines financial robustness. It reflects the ability to absorb losses and is tightly monitored by regulators.

Cost-to-Income Ratio: Operational efficiency metric. A lower ratio signals lean operations.

Credit Costs: Total provisions and write-offs as a percentage of assets. Key for understanding portfolio stress.

💿 F. How They Compare to Banks

NBFCs differ from banks not just in regulation but in business philosophy and execution. Key distinctions include:

No Demand Deposits: Most NBFCs can’t accept public deposits, making them dependent on wholesale funding.

More Nimble: Faster decision-making, quicker product rollout, and flexibility in credit appraisal.

Underserved Segments: Focus on borrowers excluded by banks: informal sector, gig economy, new-to-credit customers.

Higher Yields: Risk-based pricing leads to better spreads. But this comes with higher GNPA risk.

Less Regulatory Burden: NBFCs have lighter compliance, but the RBI is tightening norms via scale-based regulation.

During crises like COVID or the IL&FS collapse, NBFCs with robust ALM and diversified funding have shown remarkable resilience.

⚠️ G. Sector-Specific Risks

NBFCs, despite their strengths, operate in a volatile ecosystem. Key risks include:

Over-leverage: Aggressive growth can stretch balance sheets, especially in unsecured lending.

Political Risk: Loan waivers or interest moratoriums erode repayment culture and strain cash flows.

Regulatory Risk: Frequent policy changes can hurt business models, e.g., RBI's recent co-lending and digital lending norms.

Sectoral Concentration: A mono-line lender (e.g., only vehicle loans) is more vulnerable to sector-specific downturns.

🏒 H. Mini Case Studies

1. Spandana Sphoorty

A leading MFI with operations across multiple states, Spandana focuses on rural group lending. It uses the JLG model and has deep penetration in underserved Bharat. It suffered during COVID but has since rebounded with better risk management.

2. CreditAccess Grameen

Known for high discipline, CreditAccess maintains superior collection rates and risk metrics. Its operations are spread across South and West India. The company has institutional backing and strong internal controls.

3. Ujjivan Financial

Started as an MFI, Ujjivan transformed into a Small Finance Bank. It now offers MSME, housing, and personal loans. Ujjivan blends tech with touch, maintaining on-ground presence while digitizing operations. Their transition offers a playbook for MFIs eyeing banking licenses.

📊 I. Sectoral Focus & ROA Differentials

Different NBFC segments exhibit unique characteristics in terms of cost structures, risk, and returns. A common way to understand this is through the ROA (Return on Assets) Tree, which breaks down the drivers of profitability in a financial institution.

ROA Tree:

Interest Income - Interest Expense = Net Interest Income

- Operating Expenses = Operating Profit

- Credit Costs = Profit Before Tax

/ Total Assets

= ROA

This tree structure allows investors and analysts to pinpoint exactly where a lender generates its returns and where it incurs inefficiencies or risks. Let's examine how this plays out across different lending segments that NBFCs are active in:

MSME Lending

Interest Income: High, typically 20–24%. This segment demands high yields due to the inherent volatility and limited formal documentation of borrowers.

Operating Expense: Also high, as it requires door-to-door service, manual verification, and localized collection models.

Credit Costs: Moderate to high. Informal business operations and exposure to macroeconomic shocks (like COVID, commodity prices) make this a risky but rewarding space.

Net Result: Despite the risks, well-run MSME lenders with strong field teams and local knowledge can achieve respectable ROAs due to superior yields.

Gold Loan NBFCs

Interest Income: 18–22%, with most loans backed by household gold. These loans are short-tenure and easily liquidated.

Operating Expense: Very low. Branch operations are lean and standardized, making scalability high.

Credit Costs: Minimal, since gold is easily liquidated and loan-to-value (LTV) ratios are conservative.

Net Result: This is a textbook high-ROA business. Some top players report RoAs above 4%, making them highly attractive.

Housing Finance

Interest Income: 10–14%, particularly in the affordable housing segment. Yields are lower but stable.

Operating Expense: Moderate to high. Requires site visits, income verification, and document-heavy onboarding.

Credit Costs: Low in salaried borrowers, but slightly higher in self-employed and informal segments.

Net Result: Stable RoAs between 1.5% to 2.5%, with lower volatility and long-term stickiness.

Personal Loans

Interest Income: Extremely high (24–30%). These are often unsecured and short-tenure.

Operating Expense: Depends on digital maturity. Fintech lenders keep it low, but traditional models with in-person verification drive up costs.

Credit Costs: Highest among all categories. Highly sensitive to economic conditions, job losses, or fraud.

Net Result: High profit potential, but prone to large swings in profitability due to defaults.

In conclusion, an NBFC's sectoral focus isn't just a business choice—it's a core part of its identity. Choosing the right balance of yield, risk, and cost discipline defines long-term survivability and investor interest.

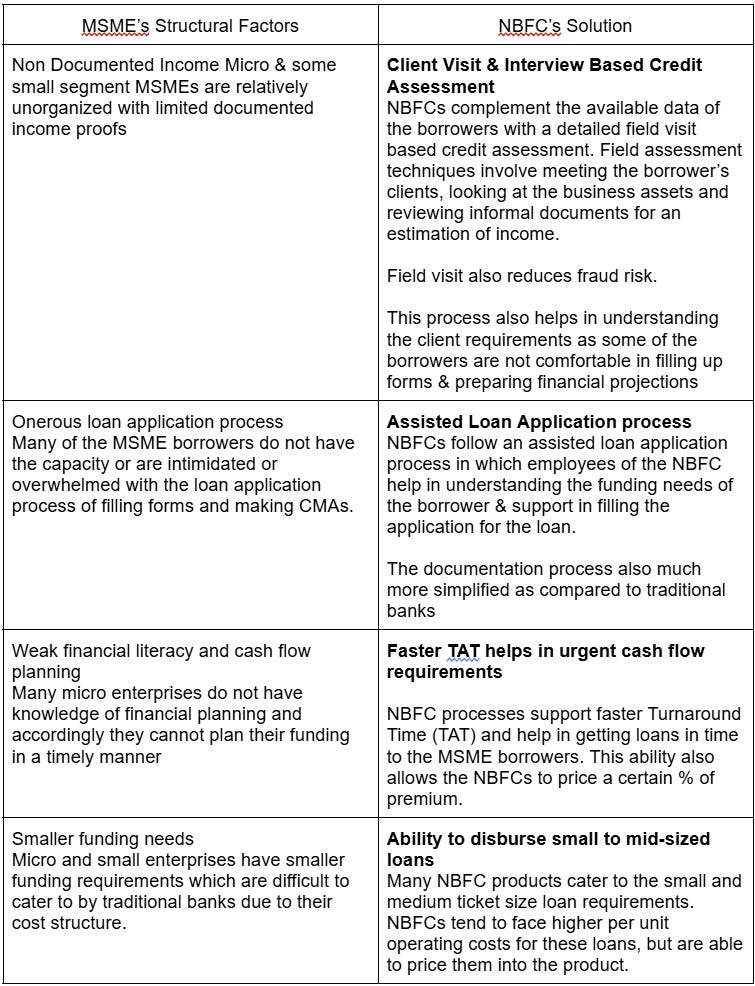

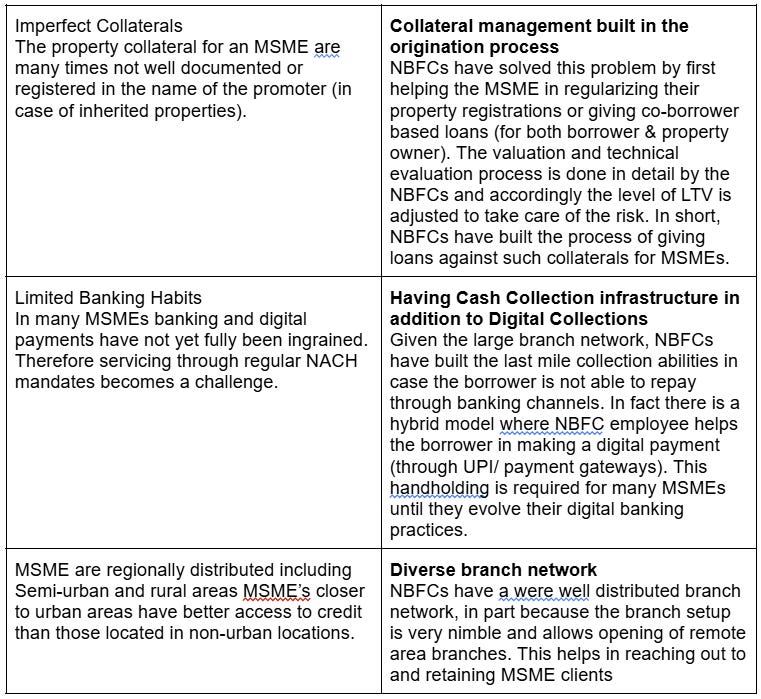

📈 J. MSMEs: The Growth Core

The Indian economy thrives on its small businesses. With over 63 million MSMEs contributing nearly 30% to GDP and employing over 110 million people, the sector is the lifeblood of economic activity. And yet, it remains significantly underfinanced.

The Credit Gap

Estimates put the formal credit gap for MSMEs at over ₹25 lakh crore. This gap has widened post-COVID as many businesses faced supply shocks, demand collapse, and rising input costs. NBFCs have stepped in where banks hesitated, offering custom credit solutions tailored to MSME dynamics.

Why NBFCs Fit Well

Policy Tailwinds

Udyam Portal: Over 2.5 crore MSMEs have now registered, making them visible to formal lenders.

ECLGS: Over ₹3 lakh crore disbursed, with NBFCs playing a key role.

TReDS: Trade Receivables platforms are helping MSMEs get paid faster by large corporates and reduce working capital stress.

Growth Potential

MSME credit has grown at a 20–25% CAGR over the last 5 years, and many NBFCs are expanding rapidly into this space. With increased tech adoption, vernacular onboarding, and embedded finance, MSME lending is expected to be the core of NBFC portfolios by 2030.

However, risks persist:

Informal Bookkeeping: Borrowers often can't furnish financials.

Cyclicality: Sectors like textiles, agro-processing, and retail are exposed to seasonality.

Still, for NBFCs that master local nuances and tech-driven underwriting, the segment offers unbeatable growth-adjusted returns.

📈 K. Other Growth Factors

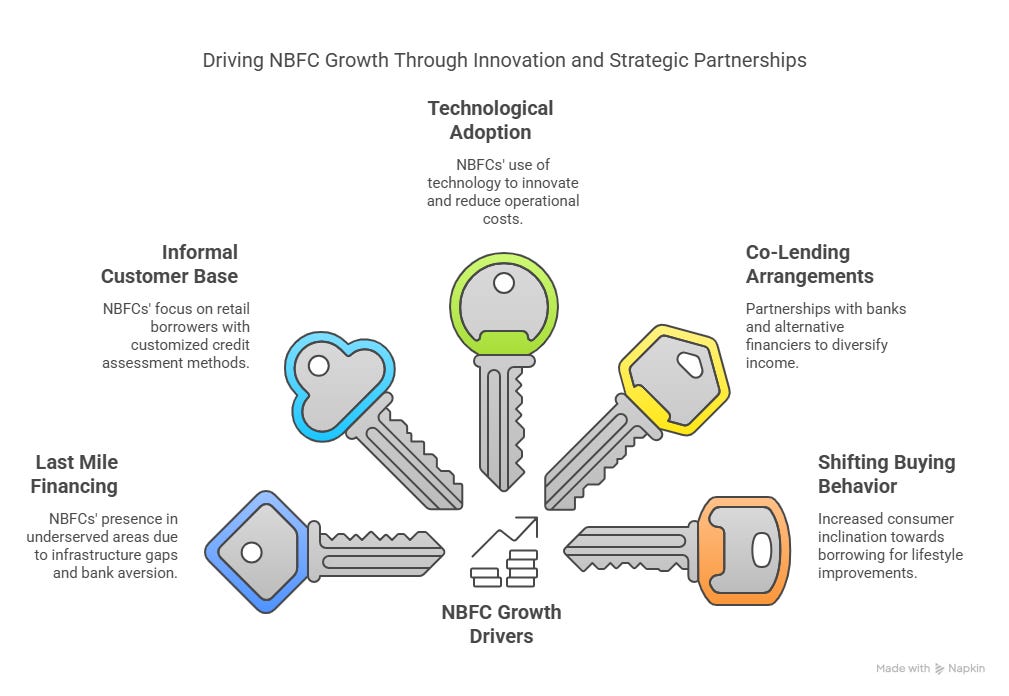

Last Mile Financing and Unbanked Population:

NBFCs have a strong presence in the unorganized and under-served areas where banks may not have a strong foothold. This is attributed to the lack of necessary bank infrastructure in these areas and an aversion on the part of banks to disburse loans to smaller companies. Further, the ease of internet access and affordable data packs have contributed to increased spending and demand for retail credit from these areas alongside raising the potential consumer base of NBFCs.

Growing Focus on Informal Customer Base:

Traditional banks may not be very keen on lending to retail borrowers from semi-urban and rural areas or small companies with weaker credit scores and lack of documentation, as compared to larger borrowers. However, in terms of volume, the number of potential customers in this category is higher and NBFCs have created a niche segment by having customized credit assessment methods based on cash flow assessment and field verification. This gives NBFCs an opportunity to extend credit to the financially weaker set of customers, a growing customer base in the informal customer segment, further opening up avenues for NBFCs’ growth.

Technological Adoption and Co-Lending Arrangements:

NBFCs deploy technological solutions to develop innovative products and lower operational costs. Since NBFCs are fairly new in the financial landscape in comparison to most banks, they are more agile and better positioned to leverage technology to enhance their reach while increasing efficiency. Additionally, NBFCs partner with various alternative financiers and commercial banks, enabling them to diversify their income avenues and reach their targeted customer base through different channels. Accordingly, bank collaborations with other NBFCs help make credit accessible to the under-banked and un-banked population.

Shifting Buying Behavior:

Over the years, there have been significant changes in the perception of consumers toward borrowing. With the need to improve lifestyle, there is an increasing inclination toward borrowing to attain a certain standard of living people. This is prominent among the younger population. Accordingly, banks and NBFCs have seen significant traction in demand for personal loans over the last decade, indicating increased awareness about credit and shift in perception towards borrowing.

Rising Demand from Retail Customers:

Retail loans are expected to have accounted for around 33% of total credit disbursed by NBFCs as of Mar-24, according to the data published by the RBI. The retail segment has shown consistent growth in credit demand throughout the pandemic alongside being a significant chunk of the customer base of NBFCs. Going forward, CareEdge Research believes that the demand for consumer durables, consumption of services, home loans and gold loans are likely to support the growth in retail demand and, consequently, aid in the new business of NBFCs.

🔁 L. Short-Term Lending = Antifragility

Traditional finance sees short-term lending as low-margin and high-effort. But in India's NBFC landscape, it's a feature, not a bug. Short-tenure loans (3 to 18 months) enable better risk management, rapid portfolio churn, and real-time business feedback.

Strategic Advantages:

Fast Repricing: Inflation rising? Interest rates can be reset in a quarter. No need to wait years like in home loans.

Faster Feedback: If a new borrower segment sees rising NPAs, lenders can pivot within 6 months. This agility is a superpower.

Cash Flow Alignment: Many borrowers (e.g., traders, gig workers) have unpredictable incomes. Shorter loans suit their repayment capacity.

Crisis Case Studies

IL&FS Fallout: NBFCs with long-tenure wholesale lending got hit. Retail-focused, short-loan NBFCs adapted faster.

COVID-19: Moratoriums hurt banks more. NBFCs renegotiated, collected weekly, and returned to growth in months.

Talebian Antifragility

Nassim Taleb coined the term "antifragile" to describe systems that gain from stress. NBFCs with short-term lending portfolios operate in a constant learn-and-adapt cycle. Every 3–6 months, they see new trends, adjust underwriting, and reallocate capital. This dynamic makes them more resilient than static lenders.

🏁 M. Conclusion

India's NBFCs and MFIs form the bridge between the formal financial system and the informal, underserved economy. Their diversity of models, ability to innovate underwriting, and proximity to customers make them indispensable.

As fintech integrations, co-lending models, and open credit ecosystems (OCEN, Account Aggregator) take root, the NBFC of the future will look vastly different. But the fundamentals remain the same:

Serve the unserved

Price for risk

Adapt to ground reality

Key Takeaways:

MSMEs are the highest potential credit segment over the next decade

Short-term lending allows rapid course correction

ROA discipline depends on segment selection and ops execution

The NBFCs that blend digital scale with human touch will not just survive — they will thrive. Part 3 will explore their transformation through digital disruption, embedded finance, and collaborative models with fintechs and banks.