Kronox Lab Sciences: Specialty Fine Chemicals with High Barriers to Entry

A specialty chemical business that looks simple — until you see what it takes to pass the purity test

Kronox Lab Sciences Ltd. (incorporated 2008) is an Indian manufacturer of high-purity specialty fine chemicals used across diverse industries. Unlike bulk commodity chemical producers, Kronox specializes in fine inorganic and organic compounds of exceptional purity, such as pharmaceutical-grade salts, reagents, and chelating agents, that serve critical functions in pharmaceuticals, nutraceuticals, research labs, agrochemicals, personal care products, metallurgy, and more.

These products are not commodity chemicals; they are made to stringent quality standards (meeting pharmacopeia and foodgrade specifications) and often customized for specific client needs. This focus on quality and niche applications creates high barriers to entry in Kronox’s market, giving the company a competitive edge.

Company Overview and Product Portfolio

Kronox Lab Sciences operates three manufacturing facilities in Gujarat, India (Vadodara district), with a total installed capacity of about 7,242 MT per year. Its facilities are strategically located near ports (Mundra, Kandla, etc.) for export access.

The company only went public in June 2024, debuting on the stock exchanges with a market cap around ₹650 crore (≈$80 million) . Kronox has built a broad portfolio of over 185 high-purity chemical products and serves 350+ customers in India and 20+ other countries, though the majority of revenue is from domestic clients.

Specialty Chemical Range: Kronox’s catalog spans numerous inorganic and organic fine chemicals, primarily various salts and reagents refined to high purity. Key product groups include phosphates, sulphates, nitrates, nitrites, carbonates, acetates, citrates, tartrates, chlorides, bromides, EDTA (ethylenediaminetetraacetic acid) and its derivatives, hypophosphites, hydroxides, and other ultra-pure fine chemicals.

In essence, many are compounds that may sound common (like sodium phosphate or calcium chloride) but are produced to meet exacting purity standards for specialized uses. Kronox often supplies these chemicals in multiple grades and formats: for example, laboratory reagents (ACS, AR, LR grades), pharmacopoeia grade ingredients (conforming to IP/BP/USP standards for medicines), food-grade additives (FCC standards), and so on.

The ability to manufacture according to varied global standards, Indian, British, European, US pharmacopeias, FCC (Food Chemicals Codex), etc. is a core strength of the company.

To appreciate Kronox’s niche, it’s useful to look at a few product families and their real-world applications:

Phosphate Salts: Kronox produces purified phosphates like sodium phosphate (monobasic, dibasic in various hydration forms), potassium phosphate, and ammonium phosphate. These are widely used as buffering agents in pharmaceutical formulations (e.g. controlling pH in injectable drugs or eye drops) and as food additives (emulsifiers or leavening agents in processed foods).

For instance, sodium phosphate is used in certain laxative preparations and in electrolyte solutions for medical use, requiring high purity. Kronox offers such salts in injection-grade quality (meeting pharmacopeia standards), which differentiates them from industrial-grade phosphate salts.

Citrate and Organic Salts: The company’s citrate range (e.g. calcium citrate, magnesium citrate, potassium citrate, zinc citrate) is used in nutraceutical supplements and pharma. Calcium and magnesium citrate are common dietary supplements (for calcium/magnesium intake), here high purity ensures they are safe for consumption and effective.

Potassium citrate is prescribed to prevent kidney stones and as a systemic alkalizer, demanding pharmaceutical-grade quality. Sodium citrate, another product, is used as an anticoagulant in blood bags and as a buffering agent in foods/ beverages; Kronox supplies it in tribasic dihydrate form for lab and medical use.

The company also makes tartrate salts (like potassium sodium tartrate, “Rochelle salt”) which find use in Fehling’s solution (analytical reagent) and as food additives, and acetate salts (e.g. sodium acetate) used in labs and in intravenous solutions as buffering agents.

EDTA and Chelating Agents: Kronox is a specialist in EDTA and its salts (disodium EDTA, tetrasodium EDTA, potassium EDTA, etc). EDTA is a critical chelating agent that binds metal ions.

In pharmaceuticals, EDTA is added to formulations to sequester trace metal impurities (enhancing stability of antibiotics, biologics, etc.). In personal care and cosmetics, EDTA is used in shampoos, creams, and toothpaste to improve product stability and efficacy (for example, zinc EDTA in oral care to deliver zinc ions for anti-microbial effect).

In biotechnology and laboratory research, EDTA is a component of buffers (like TE buffer for DNA storage) and is used to inactivate enzymes by binding metal cofactors. Kronox’s high-purity EDTA salts ensure no contamination in these sensitive applications. Additionally, EDTA-chelated minerals (like calcium disodium EDTA) can be used in veterinary medicine for treating heavy metal poisoning or as nutrient supplements

Nitrates and Nitrites: These include compounds like silver nitrate, sodium nitrate, potassium nitrate and sodium nitrite. High-purity silver nitrate has medical uses (as a topical antiseptic and in neonatal care to prevent conjunctivitis) and is also a lab reagent. Sodium nitrite (when ultrapure) is used in diagnostic reagents and some pharmaceutical processes (and in controlled low levels as a food preservative for meats, though food-grade nitrite requires stringent quality control due to toxicity).

Nitrates (like potassium nitrate) have uses in biotech fermentation (as nitrogen sources in culture media) and in heat treatment salts for metallurgy. Notably, Kronox group’s certain nitrate/nitrite mixtures are used in “Heat Treatment, Quenching, Eutectic Salt”, these high-purity salts are used to formulate molten salt baths for metallurgical heat treatments (e.g. in steel hardening), where consistent composition is crucial for safe and uniform processing.

Sulphates, Chlorides, and Others: Kronox produces salts like magnesium sulphate (Epsom salt), zinc sulphate, ferric sulphate, calcium chloride, ammonium chloride, etc. In high purity form, magnesium sulphate is used in pharmaceuticals (e.g. as an injection for eclampsia or a saline laxative) and in biotech as a nutrient.

Zinc sulphate is used in supplements and animal feed (requiring purity to avoid heavy metal contaminants). Calcium chloride appears in injectable calcium solutions for medicine, and in labs. Each of these “ordinary” chemicals becomes a specialty product when made to stringent purity, traceability, and consistency standards for regulated end-uses.

Alkali Hydroxides: Even basic chemicals like sodium hydroxide (NaOH) and potassium hydroxide (KOH) can be specialty products, Kronox sells NaOH and KOH as pellets of high purity. Laboratories and pharma companies often prefer pellet or chip form of these hydroxides with >98–99% purity, low metal impurities, and controlled carbonates.

Such reagents are used to adjust pH or drive chemical reactions during API synthesis. Commodity-grade caustic soda might contain impurities or be in flakes with inconsistent water content, whereas Kronox’s pellets are made under controlled conditions (sometimes under vacuum drying) to meet ACS or AR grade specifications.

These are critical for scientific research and quality control labs where impure reagents could skew experimental results.

Hypophosphites: Kronox offers calcium hypophosphite and magnesium hypophosphite, including grades conforming to pharmacopeia (e.g. Vet IP). Hypophosphites historically have been used as nutritional tonics (source of phosphorus) and in some pharmaceutical formulations.

They also serve as reducing agents in certain chemical reactions (e.g. sodium hypophosphite is used in electroless nickel plating). By producing these in high purity, Kronox addresses small but important markets, for example, veterinary medicine where magnesium hypophosphite might be added to mineral mixes for livestock, requiring feed-grade purity.

Custom and Ultra-Pure Products: Aside from its standard list, Kronox engages in custom manufacturing of fine chemicals to tailor purity or specifications as per customer demand. For instance, a drug manufacturer might request a metal salt with an impurity profile below a particular ppm threshold or of a specific particle size. Kronox can adjust its purification steps (additional recrystallization, distillation, etc.) to deliver the required grade.

This ability to customize at smallto-medium scale is valued in drug development and other R&D-intensive fields. The company even has a category for “Ultra High Purity” chemicals on its menu, indicating an ambition to provide electronic-grade or extra-pure reagents (potentially for semiconductor fabrication or precision industries).

While currently pharmaceuticals (about 45% of revenue) and scientific research (26%) are the largest segments served, Kronox is expanding its product development pipeline (122 products in R&D) to enter new domains like food & beverage additives, electronics chemicals, and precision industrial products. This pipeline suggests that Kronox aims to apply its purification expertise to an even broader array of specialty chemicals in the future.

High-Purity Specialties vs Commodity Chemicals

While many of Kronox’s chemical names (phosphates, citrates, etc.) sound like commodities, the difference lies in purity, consistency, and application-specific certification. Commodity chemical producers make bulk volumes of these substances (often for industrial uses like agriculture, construction, etc.) with relatively lenient specifications. Kronox, on the other hand, operates in the fine chemicals realm, producing smaller batches with tight control on impurities and physical properties.

Several factors distinguish Kronox’s specialty chemicals from commodity versions:

Stringent Quality Standards: Kronox manufactures to meet global pharmacopeial standards (IP, BP, USP-NF, EP, JP, etc.) and food grade standards (FCC), as well as ACS/AR grade for reagents. This means parameters like heavy metal content, trace organics, particle size, and moisture content are strictly regulated and tested for each batch.

For example, a pharmaceutical-grade zinc citrate must conform to limits on arsenic or lead content, assay purity, etc., as defined in a pharmacopeia monograph. Achieving this requires high-quality raw materials and robust purification processes. Kronox’s facilities are certified for ISO 9001 (quality management), GMP (Good Manufacturing Practice), GLP (Good Laboratory Practice), and FSSC 22000 (food safety).

Multi-Step Production & Purification: Unlike bulk commodity chemical production (often a onestep reaction followed by a crude isolation), fine chemicals may require multiple refinement steps. Kronox has multi-purpose plants equipped with stainless steel and glass-lined reactors, distillation columns, crystallizers, dryers, and specialized filters.

A given product might involve synthesizing an intermediate, then purifying it through recrystallization, filtration, or distillation to remove byproducts, and perhaps additional treatments to achieve the desired purity (>99% or as needed).

For instance, making ultra-pure potassium acetate could involve neutralizing acetic acid with KOH, evaporating and crystallizing the potassium acetate, then washing or recrystallizing it to eliminate chloride or sodium impurities, and finally drying it under vacuum to get an anhydrous salt. These controlled, multi-step processes ensure the fine chemical meets specifications and is consistent batch-to-batch.

Smaller Volume, Higher Value: Specialty fine chemicals are typically sold in smaller quantities (kilograms to a few tons) at much higher price per unit than commodity-grade material. Kronox’s capacity of ~7,242 MT is spread across 185+ products, implying many products have annual volumes in the tens of tons or less. The business thus emphasizes diversification and flexibility over scale.

Kronox’s plant design reflects this: it boasts the versatility to produce many different products and to run batches ranging from kilo-scale (for R&D or niche products) up to tonnage-scale for its higher-demand items. This flexibility is a competitive asset not found in large commodity plants (which are optimized for single products at huge scales). Kronox’s product mix also skews toward high-margin offerings – e.g. custom high-purity chemicals often command premium pricing, contributing to Kronox’s healthy operating margin (~30% in recent years).

Application-Specific Packaging and Documentation: An often underrated aspect is that supplying to pharma/food requires extensive documentation (Certificates of Analysis, stability data, regulatory dossiers). Kronox provides detailed CoAs with each batch, listing impurity levels, assay results, etc., to instill confidence in customers. Packaging is also done carefully – e.g. using clean-room packaging, tamper-proof containers, and in some cases inert atmosphere packing for moisture-sensitive or ultrapure reagents.

In summary, Kronox’s products occupy a specialty niche: they are often chemically identical to generic counterparts, but the purity and consistency make them suitable for critical use-cases where ordinary grades would fail. This niche is protected by high entry barriers, any competitor must invest in quality systems, obtain certifications, and undergo lengthy customer evaluations before making a dent.

Industry Dynamics and Use-Cases

Kronox operates at the intersection of the specialty chemicals industry and the life-sciences supply chain. Key characteristics of this industry include high value-add, stringent compliance, and close collaboration with customers on product qualifications. Below is an overview of how Kronox’s end-markets function and drive demand:

Pharmaceutical APIs and Formulations: About 45% of Kronox’s revenue comes from pharma APIs and finished dosage manufacturers. In this sector, Kronox’s chemicals serve as either reaction inputs or excipients. For Active Pharmaceutical Ingredient (API) production, many inorganic salts and reagents are needed in synthesis steps for example, an API might require a specific base (like K₂CO₃) to catalyze a reaction, or a phase-transfer catalyst (Kronox doesn’t list PTCs specifically, but salts like tetrabutylammonium bromide could be relevant in future). Using high-purity reagents avoids introducing unwanted impurities into the API, which is critical for meeting regulatory standards.

As excipients, Kronox’s products like dibasic calcium phosphate (a filler in tablets), sodium citrate (buffer), or microcrystalline cellulose alternatives (Sigachi, a peer, dominates MCC but Kronox might offer others) are used in drug formulations to ensure stability, bioavailability, or tablet integrity.

These materials must meet pharmacopeia monographs and be consistent, because any variation can affect a drug’s performance. Pharma companies typically approve a supplier through a rigorous audit and testing process, once approved, the supplier becomes part of the drug master file. This customer approval cycle is long (often many months or even years) and constitutes a major barrier to entry. Kronox’s long-standing relationships with top pharma clients (its top 20 customers have averaged 7–9 years relationship) show that once they secure a spot, it’s a sticky business.

Nutraceuticals, Food & Beverages: Roughly 23% of revenue comes from nutraceutical supplement makers, and Kronox is also targeting more food & beverage applications. Here the products are often mineral salts and food additives – e.g. magnesium citrate or zinc citrate for dietary supplements, potassium sorbate or sodium benzoate (if they produce preservatives) for food, etc.

The F&B industry requires FSSC 22000 and FSSAI compliance in India, and global food-grade certifications. Kronox’s adherence to Food Chemical Codex standards allows it to supply ingredients for fortified foods, sports nutrition, infant formula, etc., where purity (especially absence of heavy metals or microbial contamination) is paramount.

With rising health awareness, nutraceuticals are a growth area, and Kronox’s portfolio of mineral nutrients positions it well to benefit.

Scientific Research & Diagnostics: About 26% of revenue is derived from scientific research and lab testing segments. Kronox caters to laboratories (academic and industrial R&D) by providing analytical reagents and high-purity solvents/salts. Laboratories often order chemicals in small quantities but of very high grade (AR/GR or ACS). Kronox’s product list suggests it can supply everything from basic lab reagents (like sodium hydroxide pellets, silver nitrate, buffers) to more specialized compounds.

Competing in this space means going up against established lab chemical brands (Merck/Sigma-Aldrich, Thermo Fisher, local players like Loba Chemie, etc.). Kronox has carved a space by possibly offering competitive pricing and a broad catalog. A researcher or quality-control lab can source many reagents from Kronox in bulk packs, knowing they meet specification. Additionally, Kronox’s reagents can be used in diagnostic kits and biotech, for example, buffers for DNA testing kits or culture media components for biotech fermentation.

As India’s pharmaceutical and biotech R&D activity grows, the demand for reliable reagent suppliers has been rising – an opportunity Kronox is capitalizing on. Notably, exports constitute ~25% of Kronox’s sales and 83% of those exports go to the US, the largest pharma research market, indicating that Kronox has found customers abroad for lab chemicals as well.

Agrochemicals and Animal Health: Kronox’s fine chemicals also find use in crop protection formulations and veterinary products. For agrochemicals, certain additives like buffer salts or chelating agents improve the stability and efficacy of pesticide formulations.

For instance, EDTA salts are used to chelate metal ions in herbicide formulations to keep them stable. Kronox’s EDTA chelates can also be used as micronutrient delivery agents, e.g. Fe-EDTA or Zn-EDTA are applied to soils or foliar sprays to correct micronutrient deficiencies in plants.

Similarly, in animal health, high-purity salts (like copper sulfate, if offered, or magnesium sulfate) are added to animal feed and veterinary medicines. These applications require consistent quality because impurities (like heavy metals) could harm crops or animals. Kronox’s presence in this segment (though smaller in revenue share) adds diversification and taps into India’s large agriculture and veterinary market.

Personal Care & Cosmetics: Many Kronox chemicals are used in personal care products, for example, sodium citrate as a pH buffer in creams, zinc citrate in toothpaste (for anti-bacterial and antitartar effect), EDTA in shampoos and lotions (to improve preservative efficacy by chelating metal ions), and potassium sorbate or sodium benzoate (common cosmetic preservatives, if Kronox makes them).

The personal care industry demands high-purity ingredients to avoid skin irritation and meet regulatory safety (e.g. limits on contaminants). Kronox’s certifications (Halal, etc.) also help in markets like the Middle East for cosmetics. While currently a smaller piece of the pie, the company explicitly lists Personal Care & Oral Care as separate categories, showing its intent to grow these segments.

Metallurgy and Others: Kronox’s mention of “metal refineries” and the heat-treatment salts category indicates it serves some industrial niche markets too. In metallurgy, chemicals like sodium cyanide (for gold extraction), sodium nitrite/nitrate (for heat treatment baths), or EDTA (for electroless plating baths) are needed in high purity to avoid introducing deleterious impurities into metals.

For example, high-purity ammonium chloride might be used in metal galvanizing flux, where excess impurities could cause defects. Kronox likely supplies select clients in these areas, again focusing on quality-critical applications rather than bulk commodity needs.

High Entry Barriers

Entry barriers in this industry come from several sources, all of which Kronox has navigated over time.

Lengthy Qualification Cycles: When Kronox targets a new pharmaceutical customer, its product must undergo stringent validation. The customer will test the chemical in their formulation or process, often perform trial runs, stability studies, and even include the supplier’s details in regulatory filings.

This process can take months or years, and the customer will not switch suppliers easily thereafter (unless there’s a major issue) because switching would mean re-validation. As Kronox notes, this creates high entry and exit barriers – new competitors find it tough to displace an incumbent, and similarly Kronox’s own customers are “sticky” once won. This dynamic is a moat for existing players.

Strict Compliance and Certifications: Achieving and maintaining GMP, FSSC 22000, ISO certifications, etc., involves significant upfront and ongoing investment (quality systems, audits, documentation). It’s not just about having equipment; it’s running a culture of quality. Kronox’s compliance track record differentiates it from smaller unregulated chemical suppliers.

Many potential entrants may be dissuaded by the complexity of compliance and the costs of setting up a comparable facility. Additionally, Kronox’s traceability systems (SOP-driven processes that track each batch) give regulated customers confidence in product recalls or investigations if needed. These are sophisticated practices not trivial to replicate.

Technical Know-How: Manufacturing ultra-pure chemicals can involve tricky process steps – e.g. preventing contamination in a hygroscopic salt, or achieving a specific crystal polymorph. Kronox’s multi-year experience in handling a wide range of chemistries (acids, bases, organics, inorganics) and its roster of skilled technicians/chemists form a know-how barrier.

The company’s equipment, like glass-lined reactors for corrosive reactions or multiple distillation units, also indicates a capability barrier. A new entrant would need to invest in similar breadth of equipment to produce the range Kronox does.

Wide Product Portfolio as One-Stop Supplier: With over 185 products, Kronox can supply a broad swath of a customer’s needs from a single source. This one-stop convenience can lock in customers. They may prefer consolidating purchases with a trusted supplier rather than qualifying different vendors for each chemical.

A competitor focusing on just one or two product lines might find it hard to entice a customer away for just those items, unless they significantly undercut price or offer superior quality (both difficult given Kronox’s already specialized nature).

Despite these barriers protecting Kronox’s business to an extent, it’s worth noting the company is still relatively small in the global context. Its market share in any given product is not dominating, as the company admits, it faces competition from larger players that may have greater financial and R&D resources.

For example, global giants like Merck (Sigma-Aldrich), Thermo Fisher, or specialty chemical firms in Europe and China produce many similar fine chemicals. Kronox’s edge lies in focusing on specific customer relationships and perhaps more competitive pricing in emerging markets.

The broader industry is growing, especially in India, fueled by trends like the “China+1” strategy (global supply chains seeking to source more from countries like India to reduce reliance on China). This macro trend is a tailwind for Indian specialty chemical companies, including Kronox, potentially opening up new export opportunities if they can meet the quality previously delivered by Chinese suppliers.

Growth Drivers and Investor Thesis

From an investor’s perspective, Kronox Lab Sciences represents a play on India’s rising prominence in the life-sciences chemicals value chain. The company enjoys several competitive strengths: a diverse product portfolio, established quality credentials, longstanding customer ties, healthy profitability, and low debt. At the same time, it faces the execution challenge of scaling up a niche business in the face of competition and cyclical end-market demand. Below are key points underpinning an investment thesis in Kronox:

High Entry-Barriers = Competitive Moat: As discussed, Kronox’s business is shielded by high entry and exit barriers in its sector. The long customer approval cycles and strict product standards act as a moat, new entrants cannot easily poach Kronox’s customers or replicate its broad product qualifications.

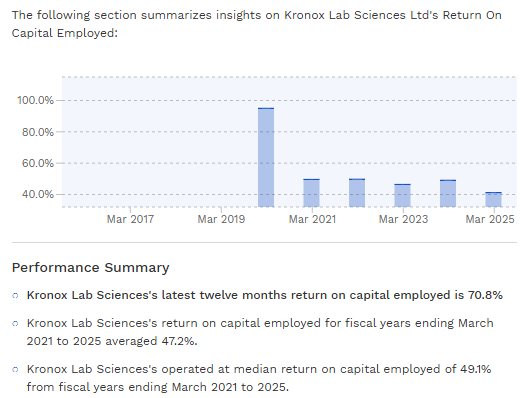

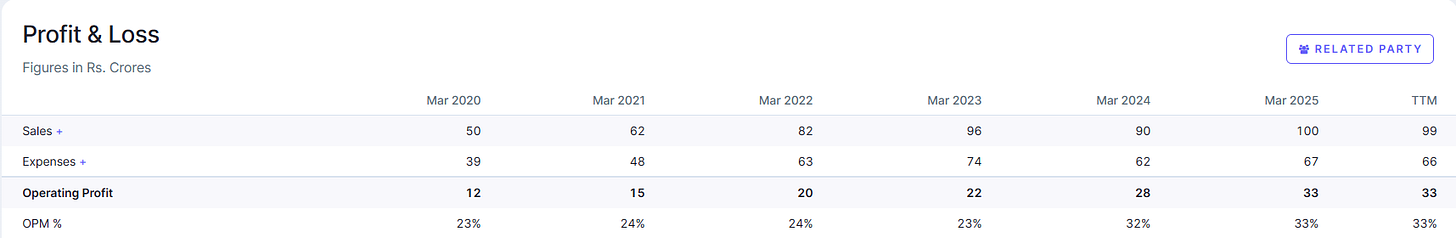

This has allowed Kronox to maintain robust margins. In FY2025, the company’s operating margin stood around ~33%, which is quite high for a chemical manufacturer . Its return on capital employed (ROCE) was above 40% , reflecting an asset-light approach (small batch production, not massive plants) and pricing power for its specialized products. These metrics indicate that Kronox has carved out a profitable niche, a positive sign for investors looking at quality of earnings.

Diversified End-Markets (with Pharma Focus): Kronox sells into pharmaceuticals, nutraceuticals, research, agro, personal care, etc., which provides some buffer against downturns in any single sector. That said, pharma and biotech remain the backbone of demand.

The pharma sector in India and globally is on a secular growth trend – the Indian pharmaceutical market, for instance, was ~$50 billion in 2023 and is expected to grow to be $57 billion in 2025 . The Indian API segment is forecasted to grow at ~14% CAGR in the next few years .

As an upstream supplier to both API and formulation makers, Kronox could ride this wave. Its largest export market, the United States, is also seeing increasing demand for pharmaceutical ingredients amid supply chain diversification. Furthermore, new growth areas like electronics chemicals (for semiconductor fabs or battery technology) and food additives provide optionalities, if Kronox’s R&D succeeds in developing products for these, it can unlock new revenue streams.

Capacity Expansion Plans: Kronox is not resting on its existing facilities. The company is in the process of adding a new manufacturing plant in Dahej (Bharuch, Gujarat) to boost capacity. This decision was partly necessitated by environmental regulatory limits at its current Padra site (a local pollution control board notice restricted expansion at that unit).

The Dahej plant will allow Kronox to increase output and take on larger orders in the future. Importantly, Dahej is a chemical manufacturing hub with port access, which could further improve logistics for exports. From an investor standpoint, this expansion indicates confidence in future demand. It also means Kronox could capture economies of scale: if it can ramp up production without a proportional increase in overhead, margins may expand. However, one should monitor how effectively the new capacity is utilized, currently, some of Kronox’s existing capacity is under-utilized (a concern the company will need to address by boosting sales volume).

Strong Financial Position: Prior to its IPO, Kronox was a debt-free company with positive cash flows. The IPO (June 2024) was entirely an offer for sale by promoters, mainly aimed at listing benefits and liquidity, which means the company did not raise fresh capital.

Even so, its balance sheet strength gives it the ability to raise funds in the future for expansion if needed or to withstand any economic downturn. The lack of debt also reflects the disciplined approach of funding growth through internal accruals, an encouraging sign for long-term investors as it typically implies management’s focus on sustainable growth without over-leveraging.

Repeat Business and Growth Outlook: One area where Kronox needs to improve, and an investor should watch, is the proportion of repeat revenues. In the past three years, only ~23% of customers placed repeat orders. This suggests that a large number of customers tried Kronox’s products only once or irregularly, which kept revenue growth modest (in fact, Kronox’s revenue was nearly flat in FY2022–23 and saw a slight dip in the nine months of FY2024 as per filings).

For Kronox to unlock its next leg of growth, it must convert more one-time buyers into regular, recurring clients. This could involve deeper engagement with key accounts, expanding the product basket for each customer, or entering longer-term supply contracts. The management has acknowledged this as a focus area and aims to increase repeat order share and export contribution going forward.

If successful, even without many new customer wins, increased wallet share in existing accounts could drive significant growth.

Risks and Competition: As part of an informed thesis, one must consider risks. Kronox’s top 20 products contribute over 60% of its revenue, a demand decline in any major product (due to a customer’s product cycle ending or a new competitor undercutting that product) could impact sales.

The company’s revenue concentration in pharma means regulatory changes or a slowdown in pharma industry could affect it. Additionally, competition risk exists: Kronox, with ~₹100 crore annual revenue, is tiny compared to many specialty chemical firms and has a “negligible market share” overall.

Larger competitors – for example, Neogen Chemicals (which makes bromineand lithium-based fine chemicals with ~₹778 Cr revenue FY25) or Tatva Chintan Pharma Chem (phase transfer catalysts and other chemicals, ~₹394 Cr revenue) have more resources and could intensify competition, though their product focus differs.

Global players like Merck or Thermo Fisher have far bigger catalogs and R&D budgets. That said, those giants often focus on very high-tech reagents or bulk lab supplies; Kronox can compete on agility and cost in certain segments. As an investor, one should track whether Kronox can maintain its margin profile as it scales, will it face pricing pressure or dilution of focus? So far, the signs are positive: despite flat sales recently, Kronox improved its operating margin year-on-year, possibly via better product mix or cost control.

Peer Comparison: In India’s listed space, Kronox stands out as a fine chemical manufacturer with a broad product range. Most peers tend to specialize in a particular chemistry or end-market.

For instance, Sigachi Industries (a peer referenced in Kronox’s prospectus) primarily makes microcrystalline cellulose (an excipient), a very different focus but also servicing pharma. Neogen Chemicals specializes in bromine compounds and electrolyte chemicals, catering to pharma and battery sectors, and trades at a higher revenue base but also higher capital intensity.

Tatva Chintan focuses on specialty chemicals like phase transfer catalysts and zeolite intermediates, largely for export markets. Compared to these, Kronox’s competitive advantage is its versatility, few companies of its size offer 180+ products spanning inorganic salts to organics, and can meet pharma, food, and lab standards all under one roof.

This versatility is enabled by its multi-purpose facilities and wide-ranging certifications. Financially, Kronox’s profitability ratios (EBITDA and ROCE) are on par or better than many peers, but its challenge is to accelerate growth to justify its valuation (Kronox currently trades at ~16 times EV/EBIT, which anticipates future growth).

If Kronox can execute well, tapping into India’s chemical growth story, pharma boom, and global supply chain shifts, it could follow the trajectory of other successful Indian specialty chemical firms that have created substantial shareholder value in recent years.

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it, so that you had 20 punches—representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all” ~ Warren Buffett

So is this a company that is worth one of my 20 punches? The current answer is NO.

When you have only 20 punches you only want to make investments where the downside is very little and the upside is huge and currently kronox is not that yet.

Given the current valuation and business prospects there is not enough margin of safety in it right now although the upside is big but this definitely a company that I am adding to my watchlist because it does have the potential to get there.

I would like to see better repeat orders from customers, if management can deliver on that promise then it definitely increases margin of safety by a decent amount. I see the business of Kronox as a business that has high repeat orders which will help the company generate good Free Cash Flow and then any growth in the business becomes sort of a free call option. Value investing in a company like Kronox is about getting the upside to growth without paying for it, that’s where superior returns are generated.

Kronox has all the ingredients of a high-quality niche compounder; sticky clients, high purity moat, and strong margins, but needs better repeat orders and a cheaper entry price to offer true margin of safety

Nicely written as always. The business's potential is well recognized by the markets. The only reason why it hasn't shot up is because growth has been pretty stagnant even at such low base. Practically ~100 Crs for the last 3 years.

Their business's high barriers to entry itself is an impediment to the Co's growth. Even Kronos has to go through the same long qualification cycles, invest heavily in R&D and maintain strict audit and compliance standards. That can lead to delayed growth.

But definitely, a Co. to watch out for. Again nicely written. Rooting for more.

Fascinating. Niche markets intriging; innovation is key beyond barriers.