Time Arbitrage: The Last Real Edge in Investing

Discover why time arbitrage is the last enduring edge in investing — and how character, not intelligence, separates long-term winners from the rest.

The Disappearing Edges

For decades, investing success hinged on having an edge. Maybe it was faster data, sharper analysis, or quicker execution. Traders once profited by exploiting inefficiencies—arbitraging small, fleeting moments when the market hadn’t caught up to reality.

But technology has transformed the financial markets into an equalizer. Real-time news, instant order executions, and algorithmic decision-making have eliminated most traditional edges. High-frequency traders now dominate with computational speed that humans can’t compete with. Information parity has leveled the playing field, making it impossible to win by simply knowing something first.

To stay competitive in this evolved landscape, quants must relentlessly innovate, crafting new mathematical models and algorithms to uncover increasingly narrow margins. Their work requires constant adaptation, as each discovery only holds an advantage for so long before it becomes obsolete in the face of market shifts or competitor advancements. Similarly, high-frequency traders are in a perpetual arms race, continuously upgrading their technology to gain even fractions of a millisecond in execution speed. Each breakthrough demands significant investment and foresight, as staying ahead means outpacing rivals who are equally determined to bridge the gap and surpass them. The pressure to remain on the cutting edge is unyielding, leaving no room for complacency.

Most edge-seeking strategies have been arbitraged away. Yet, amid all the noise, one edge remains incredibly powerful and stubbornly underappreciated. It isn’t about speed or intelligence—it’s about time.

Time arbitrage, the ability to think and act with a long-term perspective in a world obsessed with the short term, might just be the last enduring edge in investing. But it’s not easy—because it doesn’t just require smarts. It demands character.

What Is Time Arbitrage—and Why Is It so Hard?

Time arbitrage is rooted in a simple observation about human nature and markets. Investors tend to focus on the immediate future—quarterly earnings, the latest trends, or whatever is capturing media attention. Meanwhile, long-term opportunities get overlooked, misunderstood, or undervalued. This gap between short-term noise and long-term value is where time arbitrage exists.

For an investor practicing time arbitrage, their edge lies in seeing what others can’t—or won’t—because they’re too distracted by short-term volatility. Consider this example: during earnings season, stock prices often swing wildly as companies beat or miss estimates by a few cents. But seldom do these fluctuations reflect a company's true long-term potential. The time-arbitrage investor sees past the temporary noise and focuses on where the business will be five, ten, even twenty years from now.

Still, this approach is easier said than done. Why?

Dopamine Culture: Our brains are wired for quick rewards. Checking stock prices and reacting to short-term movements feels good in the moment, even if it’s counterproductive long term.

FOMO (Fear of Missing Out): When the market chases the latest trend—be it meme stocks or flashy tech IPOs—it’s hard not to feel the pull. But chasing trends often leads to chasing losses.

Short-Term Incentives: CEOs aim for quarterly results, fund managers face monthly performance reviews, and everyday investors compare portfolios with friends frequently. Everyone’s incentivized to think short term.

The Emotional Cost: Time arbitrage comes with deep discomfort. It feels lonely. It often looks wrong in the short term, and being publicly out of sync with the crowd tests patience and resolve.

Time arbitrage isn’t just misunderstood—it’s outright painful. And that’s precisely why it remains a rare and powerful edge.

Hard Work vs. Patience: A Shared Burden

Successful long-term investing is a partnership between two parties with distinct roles: the fund manager and the investor.

The manager’s job is the hard work. They perform the deep research, analyze balance sheets, examine competitive moats, and identify companies with strong long-term potential. Their focus is on uncovering opportunities and executing strategies to capitalize on them.

The investor’s job, though, is the patient work. They must stay disciplined, resist emotional decision-making, and avoid the temptation to chase short-term gains or sell during downturns. Simply put, it’s about doing nothing when instincts scream to act.

When both parties fulfill their responsibilities, great things can happen. But if either side falters—if the manager chases fads or the investor loses their patience—the partnership collapses. Trust is the glue holding this relationship together.

Anecdote #1: O’Shaughnessy and the Formula That Worked Too Slowly

James O’Shaughnessy knew what worked on Wall Street. He meticulously tested dozens of investment strategies and identified the ones that delivered the best long-term returns. Confident in his findings, he launched a fund based on them.

Unfortunately, the market didn’t cooperate for the first three years. While his strategy slowly laid the groundwork for future gains, O’Shaughnessy underperformed his peers. Investors doubted him. He doubted himself. Eventually, the pressure became too great, and he abandoned the strategy.

But here’s the twist. The person who bought O’Shaughnessy’s fund didn’t budge. They stuck with the strategy, and it worked. The formula delivered exactly as promised over the long run.

The lesson? The edge wasn’t in the formula—it was in the patience.

Anecdote #2: Richard Pzena’s Four-Year Trial

Richard Pzena’s story is a testament to the grit and resolve time arbitrage demands.

Pzena launched his value-investing firm in 1996 with a disciplined, research-driven approach. But for four years, he underperformed. Investors fled. Doubters criticized his seemingly outdated value strategy in a market enthralled by the dot-com bubble.

Still, Pzena stayed the course. He believed in his process, even as he faced mounting pressure and lost nearly all his original investors. When the bubble burst, his approach was vindicated. By the early 2000s, he ranked among the top 1% of managers, overseeing over $15 billion in assets.

What sets Pzena apart isn’t intelligence—it’s resilience. It’s the ability to stick to a strategy while enduring years of skepticism.

Anecdote #3: The Penny Doubling Story — A Parable of Patience

The Penny Parable

Life doesn’t often hand you neatly-packaged experiments in decision-making. But today, it does.

You are sitting at your favorite chai stall with three close friends when an offer is placed before each of you. A wealthy benefactor—you still can’t decide if he’s eccentric or simply a lunatic—gives you a choice.

Option one, take ₹2 crore right now. You can walk away with the money in that very moment, no strings attached.

Option two, take ten paisa today. That paisa will double every day for 31 days. By the end of the month, the total could grow exponentially, but there’s no guarantee you’ll stick it out. The choice demands patience and enduring trust in numbers—and even yourself.

You call it what it is—a bold experiment in human nature.

Your friend Ravi immediately grabs the ₹2 crore. He doesn’t even blink. “Look, I can clear my debts, renovate the house, and finally buy that Royal Enfield. Who has the time to wait?” he says.

Amit, the impulsive one, says, "Who in their right mind would say no to ₹2 crore? It’s huge! I’ve never had anything close to that!" He chooses the same option.

That leaves you and Sameer. Both of you pick the doubling penny. You don’t exactly know why—perhaps pure curiosity? The math seemed too good to ignore. Sameer says something about long-term rewards always beating short-term gratification. You nod, reassuring yourself that you’ve made the wiser choice.

But as the days go by, the real test begins.

Week 1 – The Seed of Doubt

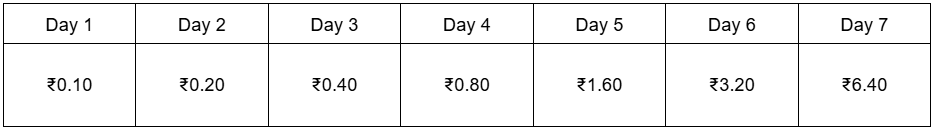

It’s only day 7 when doubt sneaks in. The paisa you chose has climbed to all of ₹6.40.

Meanwhile, Ravi buys his wife a glittering gold necklace and throws a housewarming celebration to showcase their shiny new car. Amit bought matching designer watches for himself and his wife. They’re glowing with joy, and their spouses are clearly delighted.

You’re happy for them—or at least, you’re trying to convince yourself you are. But the dinner that evening has you squirming in your seat.

Your wife, Shalini, says nothing at first. But her smile falters as she watches Ravi's wife flaunt that necklace, her bangles tinkling like a melody of success. On the way home, the floodgates open.

“How could you say no to ₹2 crore? Couldn’t we also have cleared our loans? Maybe gone on a holiday? Everyone works so hard—what makes them smarter than you?” she asks, frustration brimming in her voice.

You tell her calmly, but with a lump in your throat, “Give me 31 days, Shalini. Just trust me.” She doesn’t respond.

That night, you lie awake in bed.

Is she right? Are you a fool?

Week 2 – The Pain of Comparison

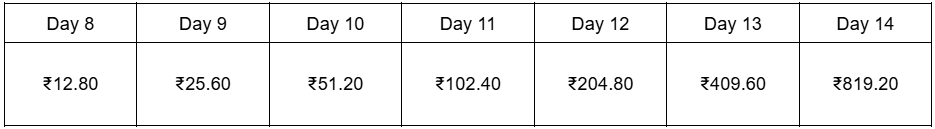

By day 14, your paisa has doubled 7 more times. It’s ₹819.20, a figure as unimpressive as it is demoralizing.

Social media makes everything worse. Both Ravi and Amit, with wide grins plastered across their faces, post photos of their families on vacation—fancy resorts, poolside parties, jet skis. Amit captions his photo, "Work hard, party harder!" paired with hashtags like #RewardYourself.

Your kids see the photos. They come running to you with excitement in their voices, asking, “Papa, can we also go to a beach resort? Why didn’t we go with them?”

You bend down to their level, swallowing a painful lump, and say, “Soon, beta. Be patient.”

But patience is a bitter dish to feed children who don’t understand why others are sipping coconuts while they’re stuck at home.

The same doubt gnaws at Sameer, too. One night over chai, he looks at you with weary eyes and says, “I can’t do it anymore. My kids are upset. My wife won’t stop comparing me to Amit. Forget the doubling—what good is any of this if you’re miserable now?”

Two days later, Sameer cashes out. He walks away with ₹2 crore.

While he smiles, you feel more alone than before.

Week 3 – The Quiet Storm

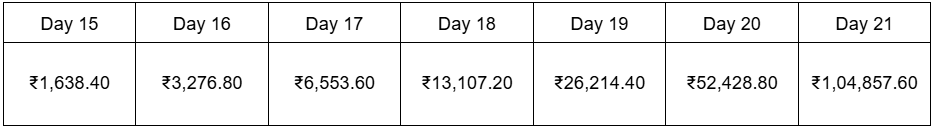

Day 21 arrives. Your paisa has grown to ₹1,04,857.6. Sure, it’s over ₹1 lakh now, but it’s still a far cry from ₹2 crore.

Meanwhile, Ravi and Amit return from their vacations. Beaming, relaxed, but with noticeably thinner bank accounts. Ravi’s already talking about how he could use some of that money to “invest in something soon.” Amit isn’t as confident—he won’t say it outright, but you sense he’s nearly burned through most of it.

At gatherings, the pressure mounts. Small, innocent jabs poke at you.

“So, still clutching that paisa, huh?” one friend teases over chai.

“Can’t believe you didn’t take the cash upfront!” says another.

Shalini is quieter these days. She stares at her phone each evening, scrolling through photos of beaches and jewelry and things you don’t own. You keep telling yourself, just a little while longer.

After all, you’re a week away from the tipping point.

Week 4 – The Tipping Point

Day 28. Something extraordinary happens.

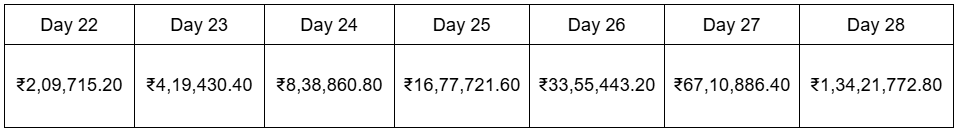

Your paisa doubles again. For the first time, it crosses ₹1 crore. By day 29, it’s worth ₹2.68 crore. Shalini, skeptical for weeks, quietly watches the numbers climb.

Day 30? ₹5.36 crore.

On day 31, your paisa leaps to ₹10.7 crore.

You’re sitting in your modest home when Shalini glances at you, half in amazement, half in disbelief. "Is this real?" she finally asks.

You nod. “It’s the power of compounding,” you smile.

When Ravi and Amit come over later that week, they laugh nervously at how little is left of their ₹2 crore. “It was nice while it lasted,” says Ravi with a faint shrug.

Amit mutters something about bad investments. They seem more interested in your success now, slightly envious, but trying to act supportive.

The Final Lesson

By day 31, your ₹10.7 crore sits untouched.

You don’t gloat. What’s the point? Instead, you reflect. This was never about intelligence. You did the same work as anyone else, had no guarantees this would play out in your favor.

It was about character—the quiet, unglamorous patience to sit while others spent, endured while others celebrated, and believed when everyone else doubted.

You smile quietly to yourself. The power of compounding may belong to math, but the rewards belong to those with the heart to trust it.

Why Time Arbitrage Requires Character

The stories above reveal something profound about time arbitrage. This edge doesn’t require genius or even unusual skill. It requires character.

It requires the ability to endure social comparison and envy, to resist the urge to do something when doing nothing is the right move. It demands emotional endurance to look wrong temporarily while being right eventually.

Patience in investing isn’t passive—it’s active. It’s a disciplined, deliberate choice made in the face of discomfort. And it’s this behavioral edge, far more than IQ, that separates great investors from the rest.

“The Inevitable is Always Certain, but Not Always Punctual”

Jim Grant once said, “The inevitable is always certain, but not always punctual.” This quote perfectly captures the essence of time arbitrage.

Long-term investing works. But it doesn’t work on your schedule. The market doesn’t adhere to neat timelines or predictable outcomes. Success requires sitting through the uncertainty, discomfort, and doubt with unwavering resolve.

Investors often think about strategy as math—but it’s just as much about psychology. The edge isn’t in forecasting better than others. It’s in having the character to endure the first 27 days of compound pennies while the rest of the world jeers and doubts.

So if you’re ready to play the long game, focus not just on what you’re investing in but on who you are as an investor. After all, the last real edge is time.